什么是数字货币止盈保护机制呢英文(数字货币 保护)

2024-08-22 23:26:57 本站作者

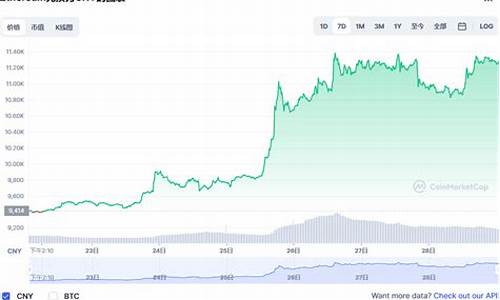

Digital currency is a type of currency that uses encryption techniques to regulate the generation of units and verify the transfer of funds, operating independently of a central bank. One of the key features of digital currency is its volatility, which means that its value can fluctuate rapidly in response to market conditions. As such, many digital currency traders use stop-loss orders to protect their investments from excessive losses. However, stop-loss orders do not always work as intended, and traders may still experience significant losses despite taking advantage of this protection.

To address this issue, some digital currency exchanges have introduced stop-profit orders, also known as take-profit orders. These orders allow traders to set a maximum profit target for their investment, and if the price of the digital currency reaches that target, the order will be executed automatically, locking in a profit. If the price falls below the stop-profit level, however, the order will be cancelled, protecting the trader from further losses.

The stop-profit order is an important tool for digital currency traders who want to manage their risk effectively. By setting a maximum profit target, traders can lock in gains when the market moves in their favor, while also limiting their exposure to potential losses. This approach can help traders make more informed decisions about when to enter and exit trades, and can reduce the emotional impact of market fluctuations on their portfolios.

However, it is important to note that stop-profit orders are not foolproof. Market conditions can change quickly, and prices can move in unexpected directions. Additionally, there is always a risk that the price of the digital currency will exceed the stop-profit level before the order is executed, leading to further losses.

In conclusion, stop-profit orders are an important tool for digital currency traders who want to manage their risk effectively. By setting a maximum profit target, traders can lock in gains when the market moves in their favor, while also limiting their exposure to potential losses. While there are risks associated with these orders, they can help traders make more informed decisions about when to enter and exit trades, and can reduce the emotional impact of market fluctuations on their portfolios.

猜你喜欢

央行数字货币怎么付款(怎么变现)

102

102

数字货币纳税(数字货币纳税标准)

51

51

手机比特币钱包注册(比特币app注册)

85

85

怎么能查找到以前的比特币钱包(怎么查看自己以前的比特币)

92

92

数字货币 试点(数字货币 试点银行)

71

71

央行数字货币要落地(央行数字货币落地会产生怎样的影响)

62

62

央行数字货币研究成果(央行 数字货币研究)

64

64

关于央行数字货币(关于央行数字货币说法错误的有 使用时可以不)

55

55

什么是枯燥数字货币呢为什么(面对枯燥的数字)

87

87

央行数字货币推出对区块链的影响(国家数字货币对区块链的影响)

87

87

eth挖矿多久结算到钱包(eth挖矿还能挖多久)

数字货币引流最佳方式是什么样的呢(数字货币引流最佳方式是什么样的呢图片)

比特币钱包地址可以查询到本人(知道比特币地址)

btc线上钱包(btc 钱包)

usd数字货币是什么意思(数字货币地址是什么意思)

央行加密数字货币发行情况最新消息图片(央行数字货币是加密数字货币吗)

imtoken钱包usdt怎么转trx(usdt转入imtoken钱包)

区块链技术应用(区块链国家认可吗)

数字货币与电子货币区别(数字货币与电子货币区别是什么)

1开头的btc钱包(btc地址开头)